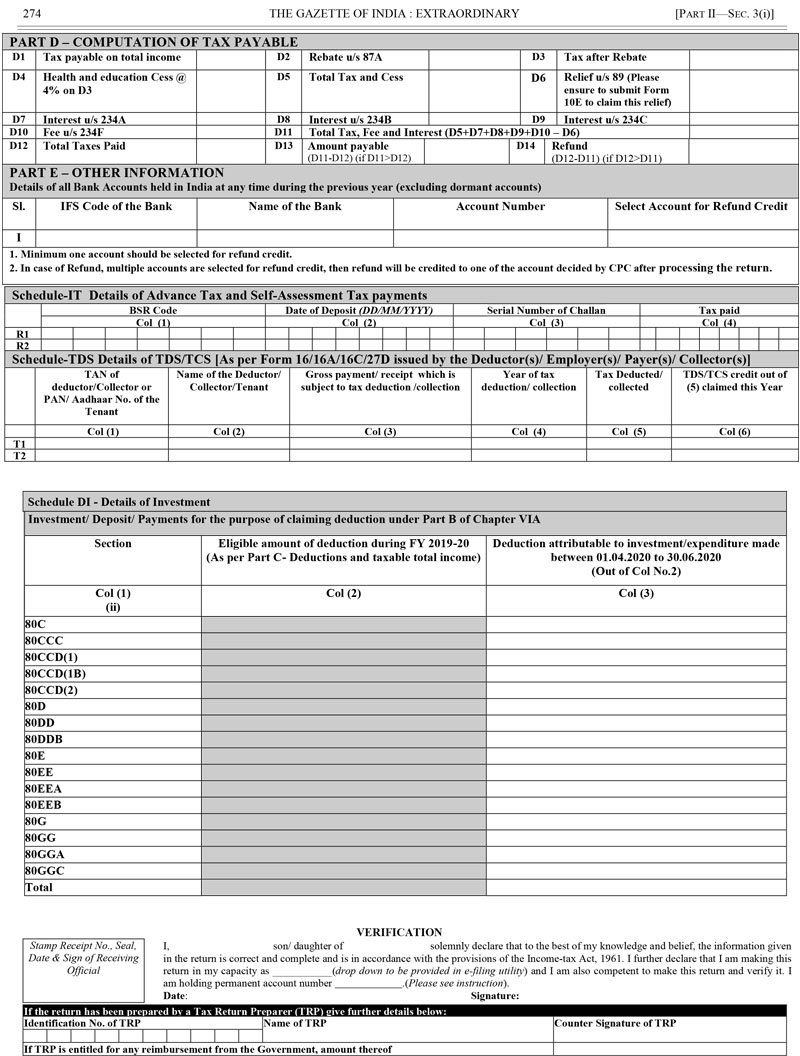

You can also get to know the tax payable or refund you will receive.

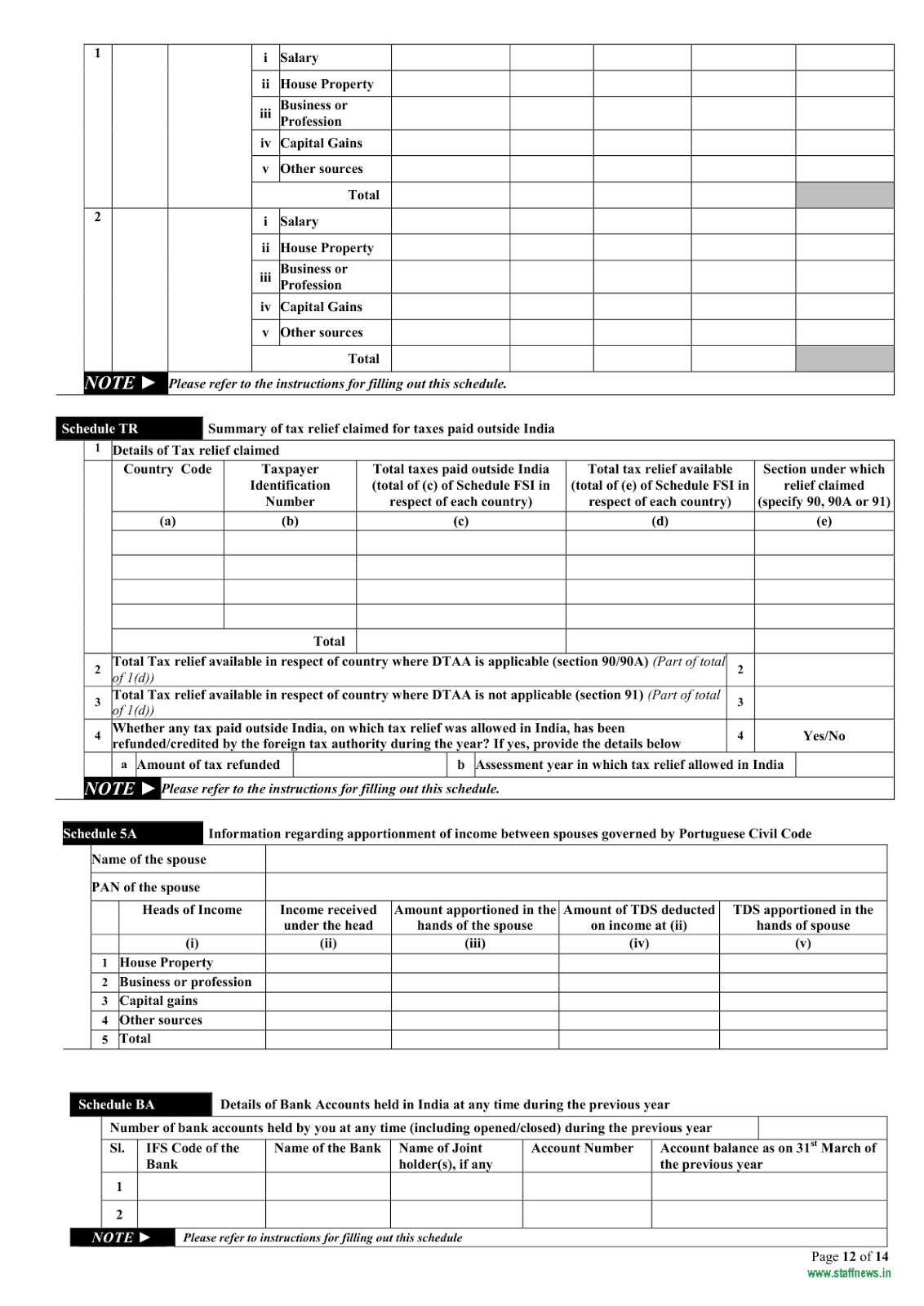

Step 5: Once you fill-in the other information, click on ‘Calculate’ to compute the tax and interest liability. Step 4: Click on the ‘Pre-fill’ button to pre-populate the personal information, income details and tax payment/TDS details, and other details. Based on the type of income you have received in the financial year, choose and download the corresponding ITR Form (offline utility). Step 3: Select the assessment year for which you want to file returns. Step 1: Visit the income tax e-filing portal at Step 2: Look for the ‘Download’ section on the homepage of the website. With the latter method, you have to download the applicable income tax utility either in excel or java format, fill the form, save the changes, generate an XML file, and upload it on the website. In the former method, you can enter all the necessary details on an online form and submit it. Income tax returns can be filed in 2 ways-online and offline. “#DigitalIndia making tax compliance easier & more efficient! Through pre-filled data in the ITRs, captured digitally, the Income Tax Department endeavours to simplify the process of filing of your Income Tax Returns making #EaseOfTaxCompliance a reality!” the Income Tax Department tweeted. Taxpayers will be able to proactively update their profile to provide certain details of income including salary, house property, business or profession which will be used in pre-filling their ITR. The option of pre-filled ITR forms is available on the new website. The Department has made the process of filing income tax returns (ITR) easier for the taxpayers by making available the Pre-filled Income Tax Return for some categories.

0 kommentar(er)

0 kommentar(er)